Step 4: Get your loan sanctioned and disbursed This includes KYC documents suchĪs PAN card, Aadhaar card, any government-issued ID, salary slip, Form 16 for eligibility check, and proof of address. These documents are required for verification. They will ask you to share the supporting documents for the details mentioned in the car loan application form. Once you fill in the details and submit the form, you will get a call back from our executive. Once you have done all these, go back and cross-check the details and hit ‘submit’.The final section in this step is entering your employment type and other personal details as applicable.Depending on the type of purchase (used or new), choose either ‘car loans’ or ‘pre-owned car loans’.It will show all the types of loans on offer that you can choose from. The next section will require you to ‘Select loan type’.The application form for a car loan requires you to select an appropriate product from the two given options: ‘Investment’ and ‘Loan’. Choose ‘Loan'.

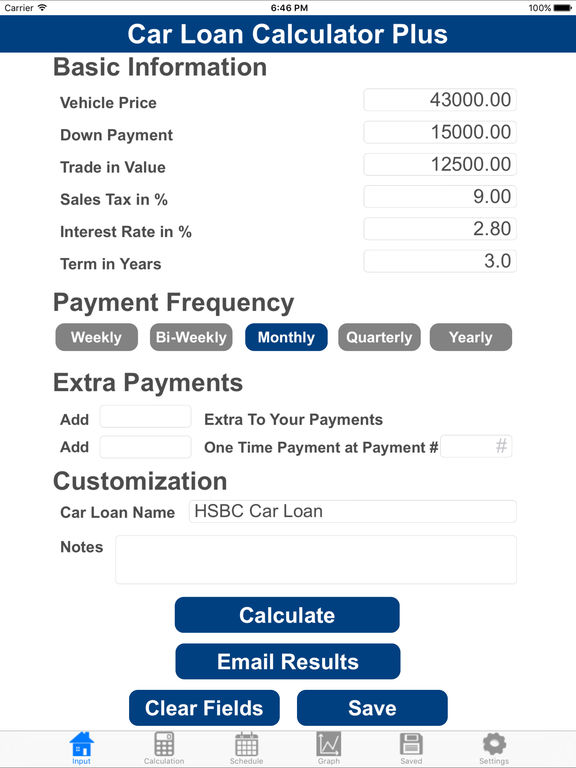

You can start applying once you are ready with the details. Needed for filling out your car loan application. As you read further, you will get an idea of the information You will be directed to a page where you will see different fields to be filled in. The first step is to start the application process by clicking the ‘Apply Now’ button on the website. It involves four easy steps: Step 1: Go to the website The loan procedure is available both online and offline, and you can either visit the nearest branch or opt for Mahindra Finance has made its car loan application process easy so that potential car owners can have a hassle-free experience. Thanks to a simple and quick loan application procedure from Mahindra Finance, you can have your car loan sanctioned in no time and can choose a convenient repayment schedule. This allows you to devote your time and attention to research car Mahindra Finance makes car ownership a reality as you getįinancing up to the full cost of the vehicle. But if you are worried about your budget, simply apply for a car loan to make your dream of owning a car come true. Moreover, it is convenient and saves time, so why not use it.Ĭalculate car loan EMIs with our calculator and apply now for the best offers on your personalized car loan.Ĭars are no longer a luxury today they have become a necessity. Using a car loan EMI calculator, you can quickly understand your loan, EMI, and how interest rates impact your finances. The loan amount for your dream car is affected by factors such as interest rates, tenure, credit history, and even the loan amount itself. In addition to using our calculator, you can also use this formula to get the answer on paper if you like to double-check the quote. You might have some questions about the process, so let's look at them first.Ĭar loan EMIs are calculated with a widely used mathematical formula, and here it is for your reference. We try to provide the best rates to fulfil your dreams, and that's the reason behind having meager processing fees and interest rates on car loans. Mahindra finance car loans offer exciting offers, and you can expect hassle-free loan processing and disbursal. After you've submitted these details, our EMI calculator for a car loan will churn this data and provide you with the best quote with further information like your EMI amount, total interest to be paid, and the final summation amount for the loan. Simply enter your metrics, such as the amount you'd like as a loan, the interest rate you're willing to pay, and the loan's tenure.

Today, getting a car loan is easy, and you can even have an idea of your repayment and EMIs with our personalized car loan EMI calculator. English हिंदी বাংলা मराठी తెలుగు தமிழ் ગુજરાતી ಕನ್ನಡ ଓଡ଼ିଆ മലയാളംīuying a car is everyone's dream if you share the same dream, then Mahindra finance car loans are your best option.

0 kommentar(er)

0 kommentar(er)